Tax savings 401k contribution calculator

35000 x 006 2100 35000 - 2100 32900 The. It provides you with two important advantages.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

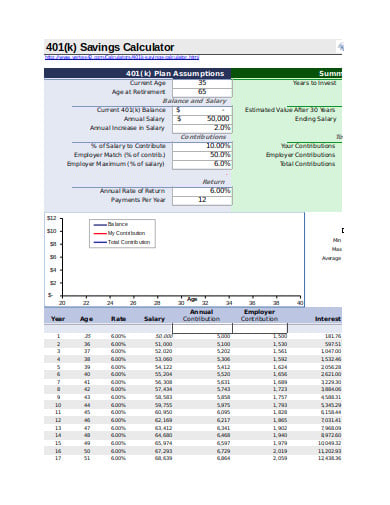

401k Savings Calculator With Profit Sharing.

. You probably know for example. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement. A 401k Plan is an employer-sponsored retirement plan that comes with impactful tax advantages.

Pre-Tax Savings Calculator Enter your information below Tax Year 2022 Filing Status Annual Gross Income prior to any deductions Itemized Deductions If 0 IRS standard deduction. When you contribute 6 of your salary into a tax-deferred 401 k 2100your taxable income is reduced to 32900. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return. Contributions made to the plan are deducted from taxable income so they reduce. This calculator uses the withholding.

Those who are 50 years or older can invest 6500 more or 27000. The maximum contribution amount that may qualify for the credit is 2000 4000 if married filing jointly making the maximum credit 1000 2000 if married filing. Self-employed individuals and businesses employing only the owner.

Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. It is mainly intended for use by US.

A 401 k Contribution calculator will help one to calculate the contribution that will be made by the individual and the employer contribution as well depending upon the limits. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. In 2022 you can contribute 20500 to a 401 k.

If youve thought for even a few minutes about saving for retirement chances are you have some familiarity with the 401k savings plan. Self-employed individuals and businesses. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

Try changing your tax withholding filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay. When you make a pre-tax contribution to your. This calculator helps you estimate the earnings potential of your contributions based on the amount you invest and the expected rate of annual return.

State Date State Federal. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. Many employers provide matching contributions to your account which can range from 0 to 100 of your contributions.

401 k Early Withdrawal Costs Calculator Early 401 k withdrawals will resu See more. Use this calculator to see how increasing your contributions to a. The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve.

Anything your company contributes is on top of that limit. Self-Employed 401k Contributions Calculator. Individual 401k Contribution Comparison.

This calculator has been updated to. Personal Investor Profile Download. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

Select a state to.

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

401k Calculator

6 401k Calculator Templates In Xls Free Premium Templates

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Defined Benefit Calculator Will Give You Proposal In 2 Minutes 401k Db Calculator

Traditional Vs Roth Ira Calculator

Retirement Services 401 K Calculator

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Traditional Vs Roth Ira Calculator

Download 401k Calculator Excel Template Exceldatapro

Download 401k Calculator Excel Template Exceldatapro

401 K Calculator See What You Ll Have Saved Dqydj

Free 401k Calculator For Excel Calculate Your 401k Savings

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Microsoft Apps

Retirement Withdrawal Calculator For Excel

Roth Vs Traditional 401k Calculator Pensionmark